RV extended service contracts, often referred to as RV warranties, have had a rocky past within the RV industry. There are a few reasons why this turbulent history came about, but they mostly come down to the policy providers. There have been companies in the past who didn’t sell reliable policies. Instead, these companies would sell policies to people who didn’t understand exactly what they were buying at the time of purchase. This resulted in backlash online where frustrated RVers described many RV warranty horror stories, making some travelers steer clear of coverage entirely.

As a whole, there are 5 primary reasons people don’t purchase RV warranties. We’re here to educate you on some truths, so you can make an informed decision on whether or not an RV warranty is right for you and your travel plans.

Prefer a video? Check out the clip at the end of this post for a full recap.

- All RV warranty companies lack customer service.

Customer service shouldn’t end when you purchase your warranty, regardless of where you bought it. The unfortunate truth is that a lot of times, it does.

The most stressful time during the RV warranty process is when you have to make a claim, which is when post-purchase support is the most valuable.

Although we don’t adjust the claims internally, at Wholesale Warranties, we have a dedicated internal support staff to help you every step of the way. With this staff, 90% of our claims are adjusted within the first phone call.

If you do have a claim that’s been wrongfully denied, the customer service comes into play again. Our expert claims staff will speak directly to the administrator as an advocate for you. With all of the moving parts of a warranty, it helps to have a liaison between everyone involved.

Our number one priority is exceptional customer service. As a broker, we have the ability to choose the policies we provide to our customers. This means we only choose administrators that also have a good name in customer service. We select companies that are easy to work with and have one simple goal of getting you back on the road as quickly as possible.

At the end of the day, there are existing warranties that don’t offer customer service. Depending on where you buy, you may not have someone you can call on during your time of need. Be sure to research the provider and peruse reviews from actual customers who have made claims before locking down a policy.

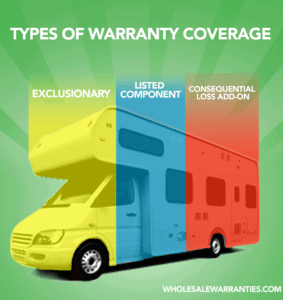

- RV extended service contracts are confusing.

Contracts are generally confusing pieces of literature. 10-15 pages of black and white legal jargon is nothing like an easy summer read.

That’s why the specialists at Wholesale Warranties are experts in the field. Here to explain and educate, we’re able to shed knowledge on the types of policies available, along with personalized coverage options depending on your rig and how you use it.

No matter where you purchase, the warranty specialist you’re working with should be fully knowledgeable in what they’re selling and educate you with that information accordingly. Take a moment to read the Terms and Conditions yourself to ensure the coverage is what you verbally agreed to.

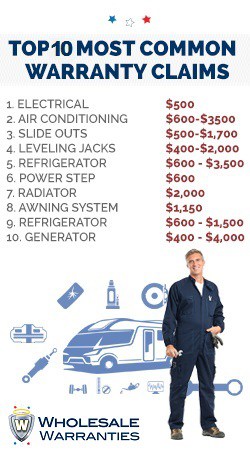

Right now, we see statistics for claims costing an average of $300 per hour between parts and labor. Even though warranties aren’t the most exciting read, that shouldn’t be a reason to avoid coverage for these high repair costs.

- RV warranty programs are not secure if they go bankrupt.

People feel unclear about the security of the coverage they’ve purchased. What happens if the warranty company or administrator go out of business?

Most warranties that are offered on the market, and all policies we offer, are fully insured programs. Those insurance programs are the financial backer for the policy. Meaning, if both the provider and administrator go out of business, you still have a financial backer to pay claims on your behalf.

If you can’t find an insurance backer on the policy, it could be a Risk Retention Group. These groups are rarer than they were 10 years ago, however, there are still a few out there.

A Risk Retention Group sells policies, collects premiums, and pools the money. The claims are paid from the pool, which works until the money runs out. If the capital runs out and there’s no insurance backer, your policy is void, and there isn’t a way to collect a refund or get reimbursed on claims.

Most companies offer insurance backed policies, so this isn’t a reason to run away from an RV warranty altogether. When you get the copy of the contract, simply check for an insurance backer. It should be a large company, and likely one you’re familiar with.

- RV extended warranties don’t let you cancel or transfer your policy easily.

Changing your rig after a few years is the norm in the RV community. You might downsize, you might upgrade, or you might fall in love with a different floor plan. It’s important to make sure there’s a transfer and cancellation process in place so your investment is secure.

Say you buy a 7-year policy, and after owning your motorhome for 2 years, you decide to sell the rig and get something else.

At Wholesale Warranties, if you’re selling your RV directly to another person, you can transfer your policy easily, and we can walk you through each step. Essentially, it boils down to a small fee and a few signatures that get submitted to the administrator. That’s it! A seamless process, which often results in a higher selling price because of the added value of the warranty.

The cancellation process varies between policies, and even between states. Generally speaking, you’re given a prorated refund for the time or mileage remaining on your policy, depending on what you’ve used more of. Any fees and claims paid on your behalf would be deducted, and you’re refunded on the remaining balance.

Cancellations can take a little bit of time, sometimes up to six weeks, but as long as you follow some pretty simple rules (or at Wholesale Warranties, call in and talk to our dedicated support staff) it’s easy to get your cancellation refund sent out to you.

Cancellations can take a little bit of time, sometimes up to six weeks, but as long as you follow some pretty simple rules (or at Wholesale Warranties, call in and talk to our dedicated support staff) it’s easy to get your cancellation refund sent out to you.

If you’re canceling because you purchased a new unit and traded in your old unit to a dealership, we can apply the prorated refund towards a new policy on your vehicle. We make it simple, so it’s a one-stop shop for wherever the next leg of your RV journey takes you.

- Roadside assistance isn’t reliable with RV warranties.

Roadside assistance is important, and you shouldn’t hit the road without it. That being said, some warranty programs add ancillary roadside benefits – but they’re usually limited, and they’ll stop towing at around $700. This roadside is not the only program you should rely on.

If you’ve experienced towing an RV, you’ll know $700 won’t get you far. Although this addition is a great side benefit, it’s not the primary reason to buy a warranty – and they’re not enough to take the place of an entire roadside assistance contract.

You should invest in a standalone roadside assistance policy. These policies are inexpensive and can typically be secured for 1-7 years. When looking for a quality policy, first make sure that it has unlimited towing. It’s expensive to tow motorhomes and towable RVs, so make sure you’re not limited with your policy.

Additionally, find roadside that’s built for RVs. Towing an auto is not the same as towing an RV, especially if you have a larger rig. There are special considerations for motorhomes, and you want a plan that’s built for RVs.

At Wholesale Warranties, we offer the Viking Protection Plan. This roadside assistance policy is familiar with towing motorhomes and crafted for active RV travelers.

There are additional benefits with this plan such as emergency trip interruption and emergency message relay. In an uncomfortable situation where you’ve gotten in an accident, or suffered a breakdown of some kind, these additional benefits specific to the RV lifestyle will make your roadside assistance that much better.

These common concerns with the RV warranty industry as a whole is why Wholesale Warranties exists. We know there are companies and contracts that haven’t been there for customers or lived up to their promises. We were born out of this need within the RV community.

We address each of your concerns by having contracts we know you can count on, along with people on our staff to assist you every step of the way. Our policies are fully insured and built for active RV travelers so you can stay on the road knowing your policy will be there when you need it most.

If you’d like a personalized RV extended warranty with unparalleled post-purchase support, fill out the free quote form below, and a warranty specialist will assist you.

Get a Free Quote

I don’t buy an extended warranty anymore, because even though I never made a claim in 5 years, I still had to pay a big fee to cancel my extended warranty, and all of the providers assess this kind of charge. Disgusting rip-off.

Hi Cowan,

So sorry to hear you have had trouble cancelling policies in the past. At Wholesale Warranties, all of our policies are fully cancellable for a pro-rated refund, with only a $50 cancellation fee. We understand RVers change vehicles often, so we only work with providers who offer fair cancellations.

Thanks for sharing your experience!

With your warranty is it paid in full or installment payments.

Thank you for reaching out! We have both paid in full and payment plan options available to our customers, so you are able to pick the plan that makes the most sense for you. If you’d like to work with a warranty specialist to explore your options, please give us a call at 800.939.2806, or submit a quote request here.

Let us know if you have any additional questions!

I have an extended warranty on my 2007 motorhome. However each time I have had to have an item repaired, I find that parts for items that old are no longer available. The warranty company will pay me for the fair value of the part, but it is up to me to pay the cost to replace an unrepairable appliance. Whether it is a washer/dryer or my Atwood electric jacks. Since no parts are made, they leave me hanging for the near total cost.

I am on my third TT. The first two had accidents which caused them to be totaled, since repairs would have cost more than what they were worth. I know getting an extended warranty is like gambling. But something told me to pay for the warranty, it was for 5 years. Well, I just saved over $1200 on repairs. Since I’m retired now I would not have been able to afford fixing it myself. I just have to pay about $350 for none covered things that were fixed.